Issue #001: Lolli

A post on Lolli's product, growth model, and how Lolli can take their growth to the next level

Bitcoin and Lolli

Bitcoin is a digital currency that was created in 2009 by an unknown individual or group of people using the pseudonym Satoshi Nakamoto. It is the first decentralized digital currency, meaning that it is not controlled by any central authority such as a government or financial institution. Instead, it is based on a decentralized network of computers that use complex mathematical algorithms to verify transactions and manage the supply of the currency.

Bitcoin offers a new and innovative way of conducting financial transactions. Unlike traditional currencies, which are controlled by central authorities and can be subject to inflation, Bitcoin is decentralized and has a limited supply, making it potentially more stable and resistant to inflation. Additionally, it allows for fast and inexpensive transactions, making it a potentially useful tool for people in countries with underdeveloped financial systems or high levels of inflation.

Bitcoin has become a mainstay of public conversation and cultural relevance over the past 13 years. Many believe that Bitcoin is a good investment because it has a limited supply and a growing user base, which could potentially lead to an increase in value. Bitcoin has shown strong price growth in the past and has been relatively resilient to economic downturns, despite its susceptibility to short-term volatility and price fluctuations. However, Bitcoin accessibility, user experience, and mainstream adoption haven’t made progress nearly as quickly. Alex Adelman and Matt Senter saw an opportunity to bridge this gap — they did so by creating Lolli.

Lolli is the rewards application that gives you Bitcoin back when you shop directly from the websites of 10,000+ stores. When you configure Lolli and successfully make a purchase, these partner stores pay Lolli a percentage of that transaction. After Lolli receives that affiliate revenue from partner stores, Lolli pays you the shopper a percentage of your transaction in Bitcoin “Credits,” sending it to your Lolli wallet. Lolli realizes revenue in the difference between their payout from partners and your gains in BTC.

Use Cases & Monetization

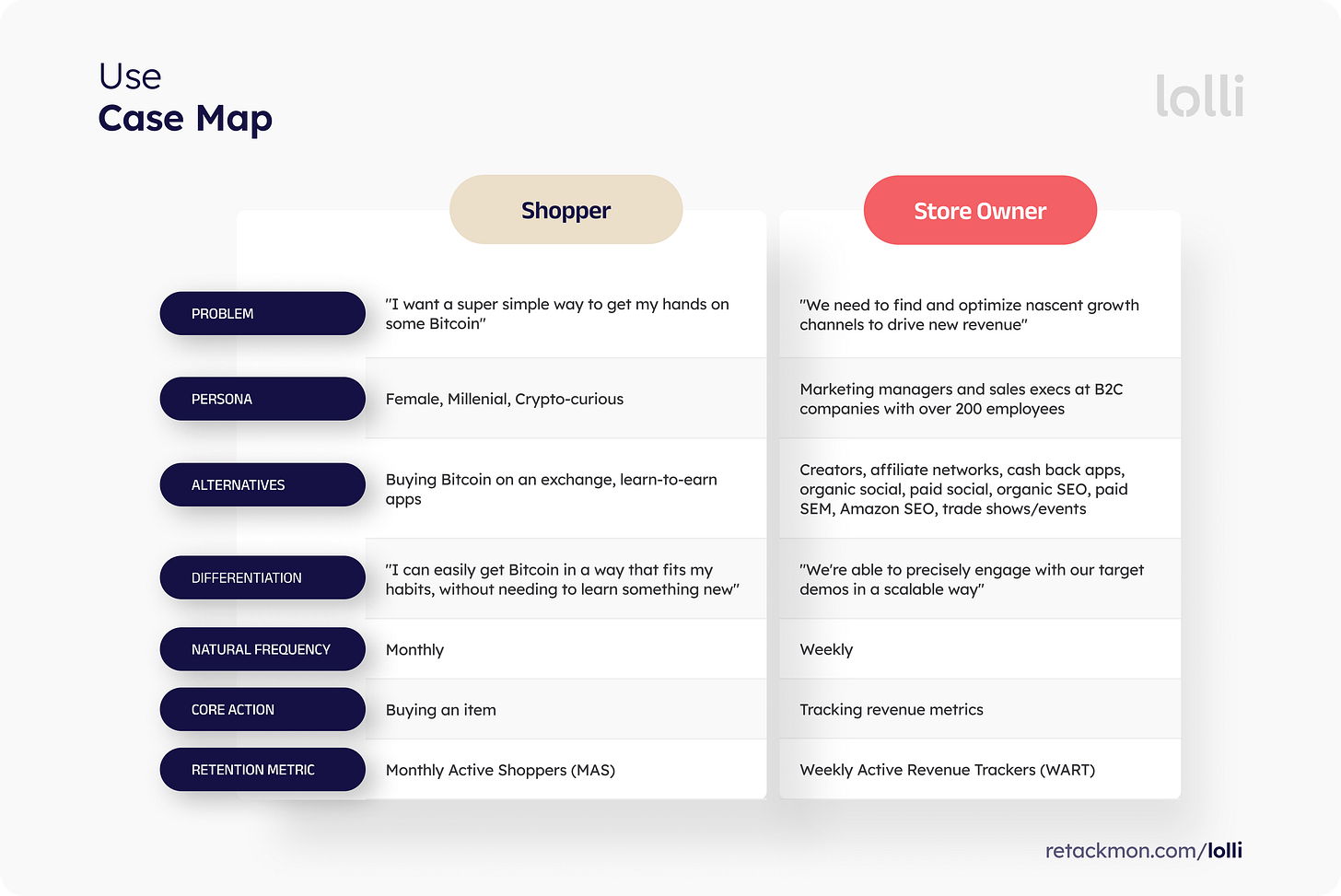

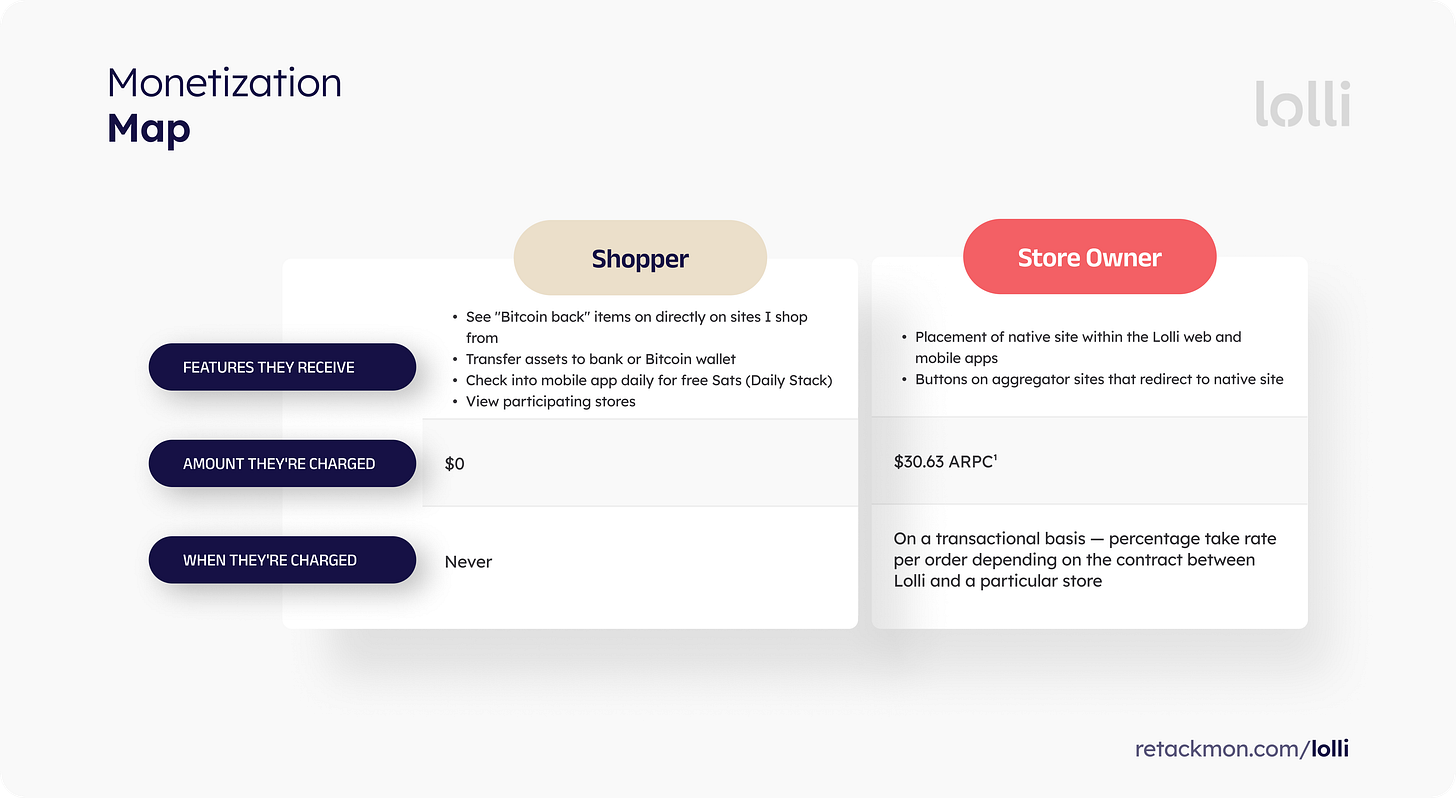

Here’s how I perceive Lolli’s use case and monetization maps playing out for both shoppers and stores:

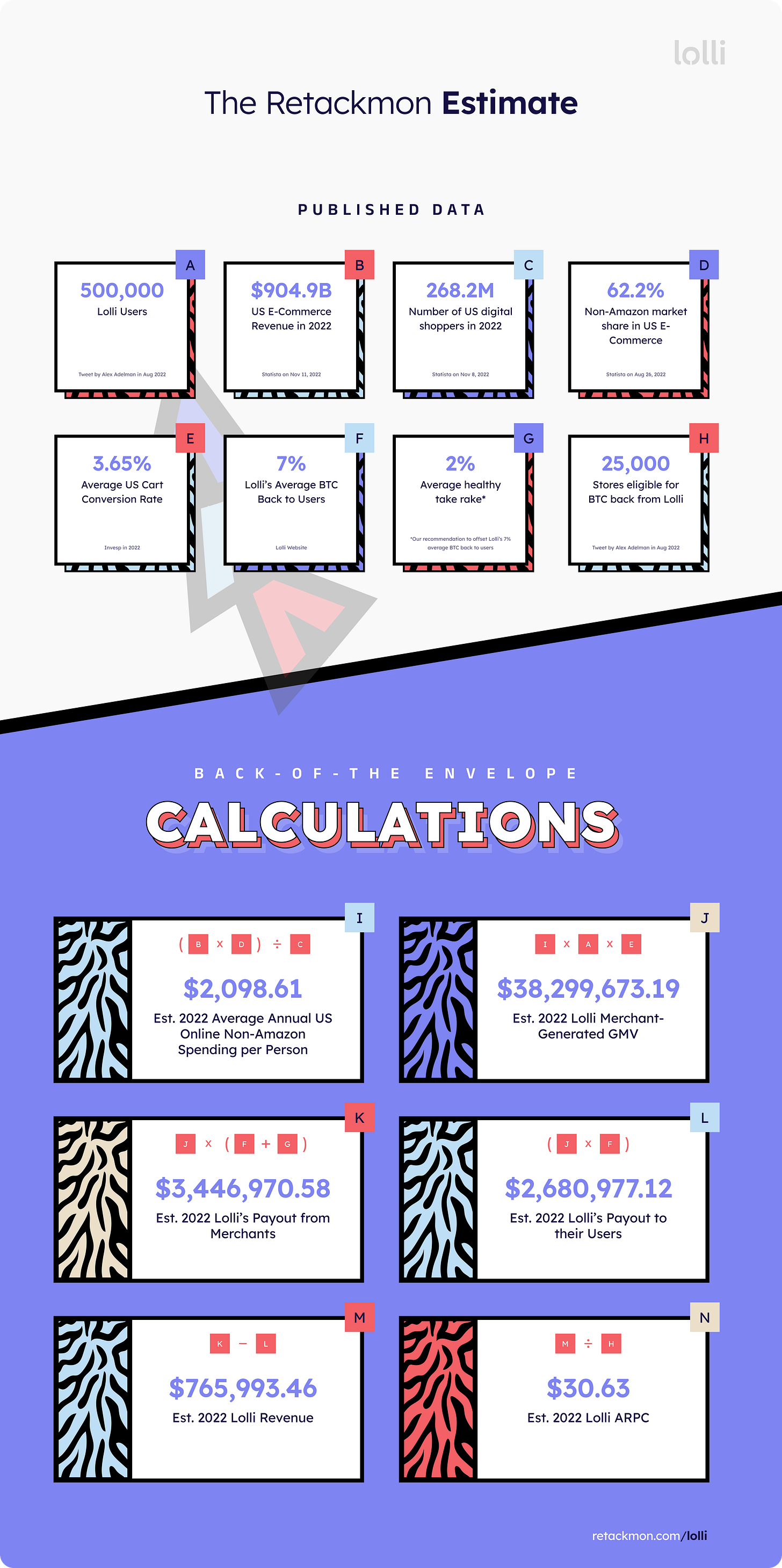

¹ Back-of-the-envelope calculation explained below

The Average Revenue per Customer (ARPC) calculation for Lolli’s store owners in 2022 listed in the monetization map above is a fermi estimate that accounts for figures published by the US government, market data companies, and Lolli themselves 👇🏽

In fulfilling the mission of mainstream Bitcoin adoption, Lolli’s current target market on the consumer side are those who are interested in Bitcoin in some shape or form. These target users likely don’t have a pressing need to claim their own BTC, but do have the desire to hold Bitcoin as an investment to hedge against inflation. This rings especially true in today’s economic environment. As the economy heads into a recessionary cycle, people are looking to actively save money in ways that align with their behaviors, habits, and values. Online shopping is a widely-adopted behavior that is deeply ingrained in today’s society. As such, the current Lolli product meets the needs of this specific persona.

However, “Bitcoiners” and advanced Bitcoin users like developers running their own Bitcoin nodes likely do not fall under the Lolli purview, at least in the short term. Bitcoiners are currently anti-personas, as they have their own established channels of attaining BTC. Channels that are not accessible to the mainstream. These users who are responsible for a lot of today’s early adoption will actively seek Bitcoin, regardless of external factors like the macroeconomy.

Establishing clear anti-personas for the short-term helps Lolli to inform:

the misleading data to filter out,

the healthiest metrics to track, and

the best marketing channels to double down on.

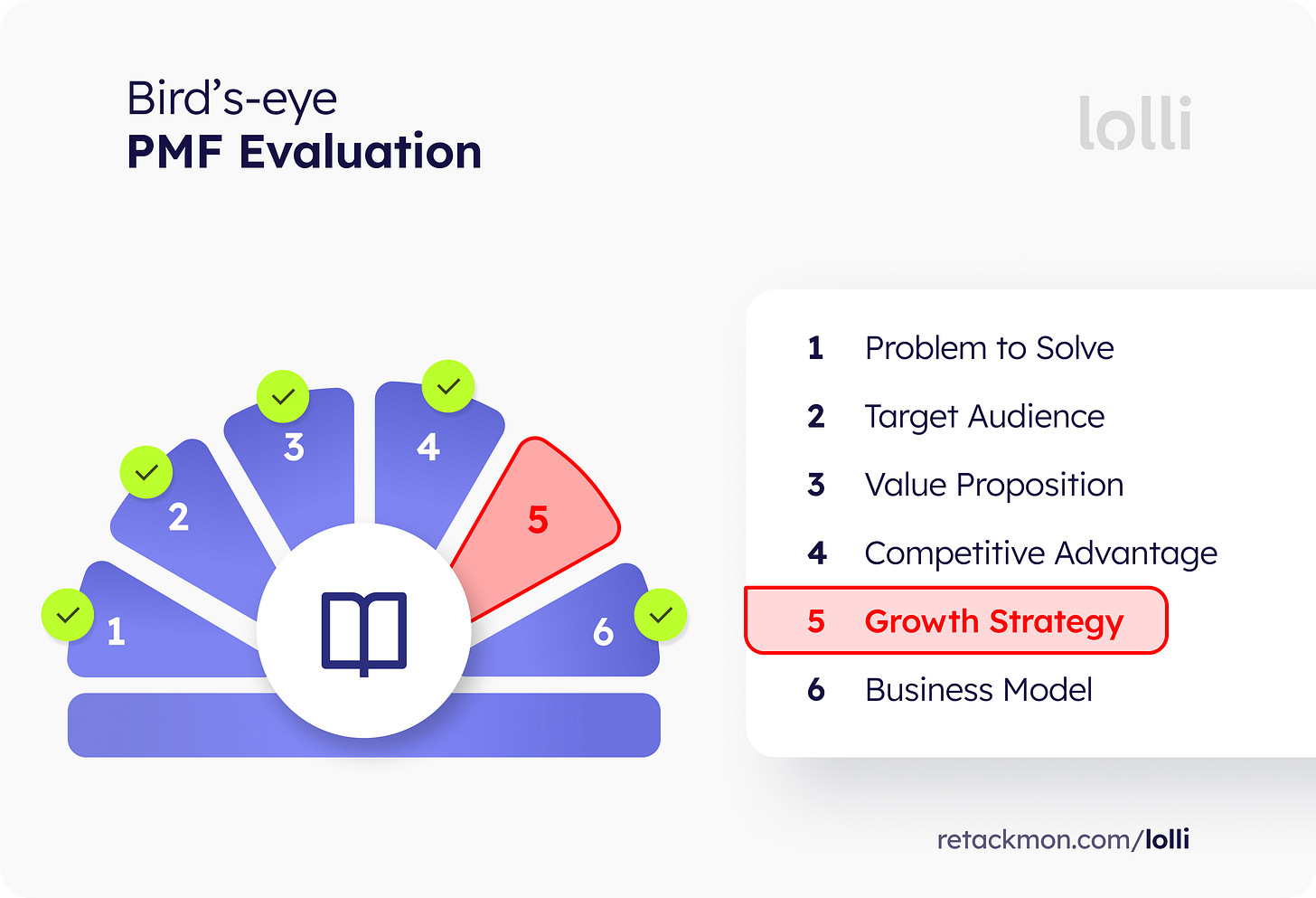

The above qualitative data, along with consistent press coverage on mainstream outlets like Emily Chang’s former Bloomberg Tech daily show, indicates that the Lolli team has a strong glimmer of Product-Market Fit. If we were to score Lolli’s PMF using the PMF Narrative Framework from Sachin Rekhi and Reforge, this is what my what my evaluation would look like.

The foundations of the product are solid for shoppers and store owners — shoppers on the demand side and store owners on the supply side. However, Lolli has yet to realize scalable and sustainable growth through retention, acquisition, and monetization on both sides. Before ideating any big growth moves, let’s deep dive through the current Lolli user experience and growth model. To add a unique twist, I’ll also give a step-by-step explanation of what’s going on under the hood in a way that’s accessible.

Journey through the Lolliverse

The traits of the Lolli shopper and store owner personas couldn’t be more different — the same goes for initial user acquisition.

As previously illustrated in the use case map, the shopper “wants a super simple way to get their hands on some Bitcoin,” with little-to-no effort, time, and/or money. Unlike Bitcoiners, the shopper has little-to-no knowledge, as well as minimal intent to immediately solve their problem. However, as opposed to the smaller Bitcoiner persona, the size of this passive user population is massive. Targeting a massive mainstream population with high interest, low intent, and fuzzy revenue attribution greatly limits the number of potential channels that marketers can use. Organic social seems to be a natural fit in the short term when considering other constraints like team size and total funding. Lolli does a great job on their existing social creative — they focus on cultivating their overall brand awareness and cultural relevance, instead of talking about highly-nuanced Bitcoin topics that would detract from their mission and competitive advantage relating to accessibility. Organic SEO seems to be a natural fit in the long term when considering the growing interest in Bitcoin and time it takes to build truly-defensible domain authority. It would be really cool to see Lolli use their competitive advantage of accessibility to invest in Bitcoin-related educational content that’s easy to read, understand, share, and further engage with other content on their site.

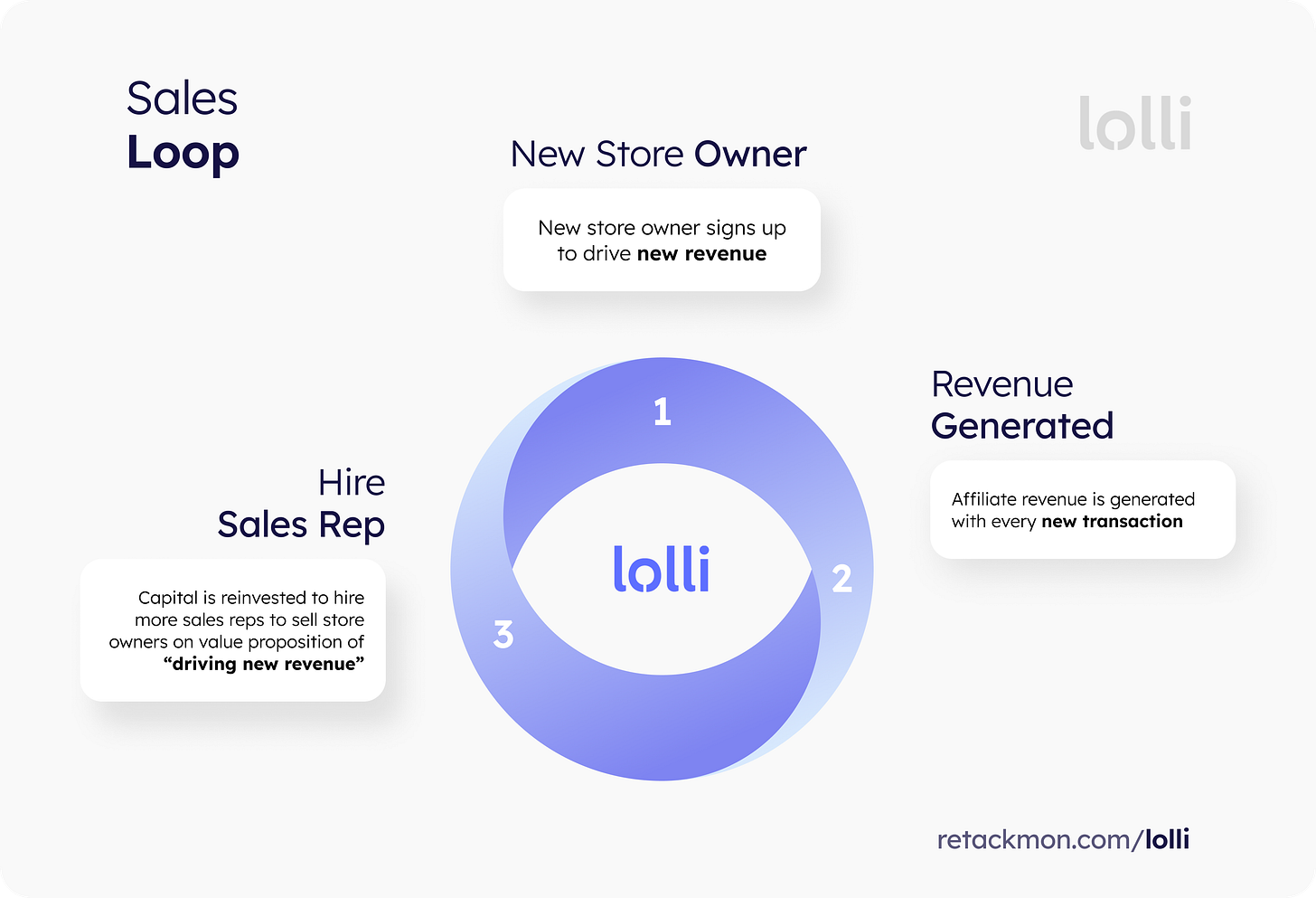

As opposed to the shopper, the store owner is looking to “optimize nascent channels to drive new revenue.” Since store owners have high intent, high interest, and clear revenue attribution, Lolli is now open to using more types of channels including those that are paid. The first channel that comes to mind is sales. As a new store owner signs up, affiliate revenue is generated from transactions on the store that are driven by Lolli, and that affiliate revenue is reinvested into hiring more sales reps to distribute that primary value proposition of “driving new revenue” to attract more store owners.

Now that we have a shopper’s attention coming from organic social and a prerequisite supply of store owners acquired through sales efforts, it’s time for the shopper to set up the Lolli browser extension. It’s critical that the shopper successfully installs the extension in order for them to realize the aha moment of getting Bitcoin back. For those using Chrome, the only setup that is needed is to:

click the link to the Chrome extension page in the header

click the “Add to Chrome” button

click the “Add Extension” button after reading permissions

sign up for a Lolli account

It’s not often that I shop from a “I want to shop from this brand” lens. I’m someone who tends to shop from an “I need these physical items with these characteristics” lens. As such, e-commerce aggregators like Amazon tend to be my default place to buy physical goods online. Lolli takes this behavior into account. After finding a fire pair of Adidas kicks to add to my Amazon cart, Lolli injects a couple of buttons onto the Amazon page indicating that I could get 15% back in Bitcoin.

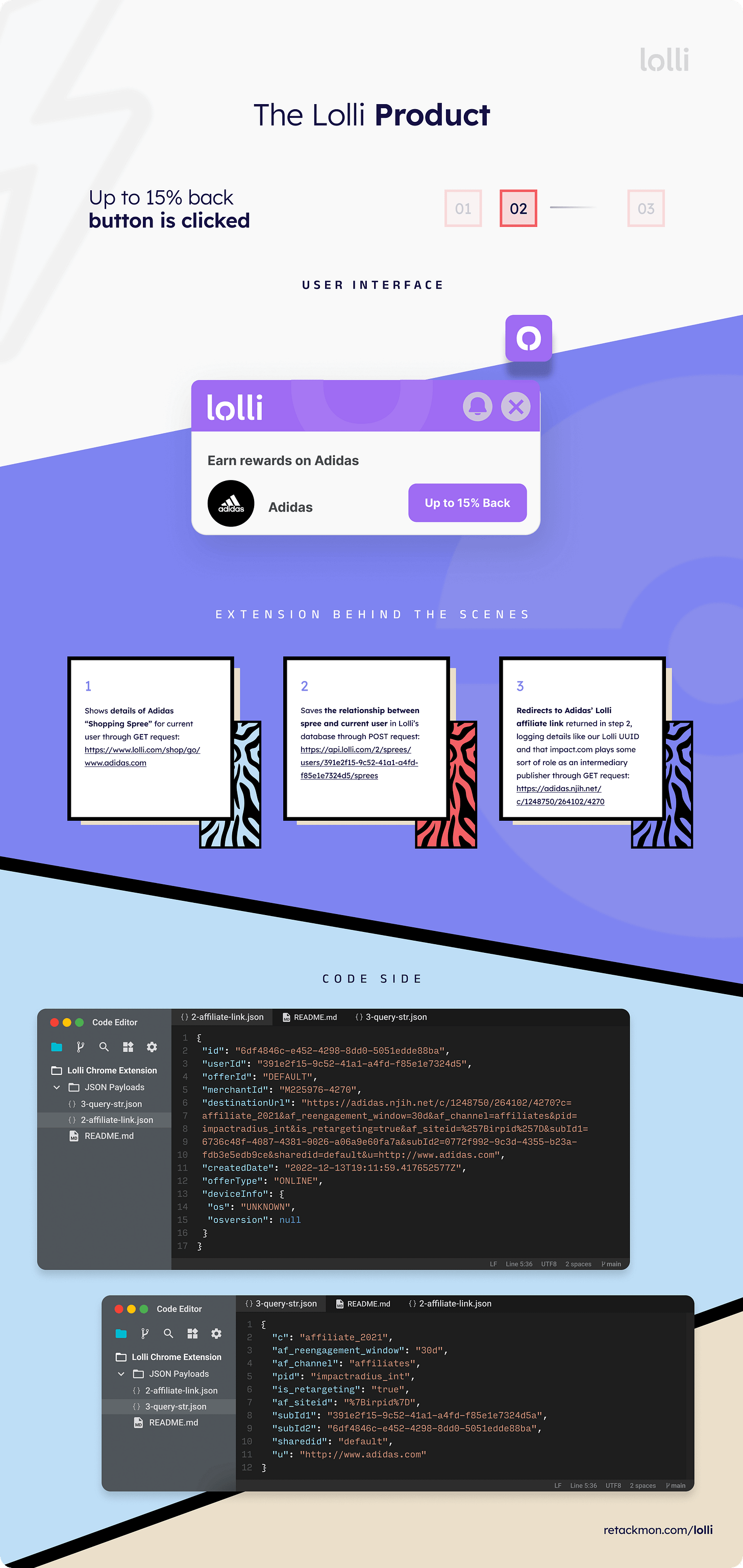

The Lolli Chrome extension was able to do so by listening to certain browser events that were being fired off in Chrome. These events are being triggered constantly by the browser, giving Lolli the power to search for potential Bitcoin I can save money on any domain and every web page that I interact with. When making this search, the Lolli Chrome extension sends a “GET request” to Lolli’s own servers to see if that the current domain I’m on is a Lolli ad partner. Lolli sees that Amazon’s currently not an ad partner, so it doesn’t add any Amazon deal buttons to the page. However, Amazon item pages hold a lot of relevant data that can give Lolli insight as to whether or not they can start to fulfill the “Bitcoin back” value prop at this point in time. As such, Lolli sends the Amazon Standard Identification Number (ASIN) and manufacturer details of the item back to Lolli servers via a “POST request.” Lolli is able to identify that I’m indirectly interacting with the Adidas brand, as the Lolli extension then sends a “GET request” to their servers to see if Adidas is a Lolli ad partner. The Lolli extension gets confirmation back that Adidas is an ad partner, so the extension asks for details of Adidas’ deal from Lolli servers on this go around through another “GET request.” The extension then uses the data returned from this latest request to:

add buttons on the Amazon item page,

indicate the highest Bitcoin commission that Adidas can give back, and

set up the interactions on the deal button link to power the next leg of the Lolli UX

After I click the deal button link, I’m linked to a page that shows the details of the deal that Adidas has with Lolli. While that interaction is going down on the surface, the Lolli extension simultaneously logs my unique interaction with Adidas behind the scenes in Lolli’s database through a “POST request.” Lolli servers then return a custom Lolli affiliate link with a non user-friendly domain to Adidas’ own affiliate link server. Lolli passes a lot of details to Adidas just through the link itself, including my hashed Lolli UUID and that impact.com plays some sort of role as an intermediary publisher in the “Lollidas” relationship.

Adidas’ affiliate link server then redirects me to the Adidas homepage, where I can start searching for the item I saw on Amazon. After I check out that item from the Adidas site, Adidas themselves sends information about my order back to their own affiliate link server through a “POST request.” This information includes data like the SKU, quantity ordered, and a hashed version of my email. We don’t know exactly what Adidas does behind the scenes with my order information, but it’s probably super interesting from a technical and product perspective. What we do know is that Lolli somehow gets wind of my order and notifies me of the incoming 15% back of my transaction in Bitcoin, along with my Order ID that Adidas’ passed to their affiliate link server. Lolli then asynchronously deposits these Bitcoin “Credits” into my Lolli wallet. Since the deposit is not instantaneous, I’m guessing that the proximity to the order is based on a number of increasingly-programmable factors like the nature of the contract between Lolli and a certain vendor, how much cash Lolli has on hand, the retention rate of that user, and more.

This is how Lolli helps save people money. Growth does not originate solely from marketing, sales, and product teams — all of these technical decisions made by Lolli’s engineers have enabled Lolli to grow to where it is today. As teams scale, it comes down to a constant re-alignment and re-acknowledgement of:

engineers realizing that they can level up by learning more about the business-related fundamentals of the product they’re coding, and

other stakeholders realizing that engineers can have a tangible impact on business metrics and KPIs

How Lolli can level up like crazy

Sequencing a technical lens on top of other product, marketing, and sales perspectives further informs work that Lolli can do right now to drive oversized impact and fulfillment of their grand product vision. Since the core Lolli UX is already pretty solid, we’d need access to Lolli’s internal usage metric and cohort data to make recommendations for big optimizations on the current activation experience. Based on the above data we do have access to, one relatively obvious optimization that will instantly lift monetization metrics is to link the button click directly to the SKU on the ad partner’s website, instead of being routed to the ad partner’s homepage. Lolli’s engineering team can create a constantly-running background job that crawls through all of their ad partners’ sites and indexes all of their SKUs. Ad partners can make this item-specific redirection functionality even easier to implement by constantly sending Lolli spreadsheets that contains data of all of their SKUs.

In addition to the above 1 to N optimization, here are some big but immediately-executable 0 to 1 feature ideas that I think can help Lolli level up their growth strategy in a very meaningful way:

Lolli for Creators

A sustainable channel for shopper acquisition might be the biggest bottleneck to Lolli’s growth right now. Organic social is a great channel for Lolli to use due to the high-interest-but-low-intent nature of the “wanting a super simple way to get their hands on some Bitcoin” use case. However, Lolli’s social team is the one of the only entities who’s consistently driving Lolli’s brand awareness. There needs to be a bigger “branching factor” in the constantly-trickling brand awareness that’s being driven to Lolli. In today’s economic environment where people are trying to make passive income, launching an affiliate program where there is high-intent from creators to make money can drive a consistent set of eyeballs to Lolli real estate. Lolli’s Creator Program can include features like a Pallet-like curation board, but for favorite stores/items instead of job openings. It can also enable creators to collab with Lolli on genuine Lolli/BTC/store-driven/culturally-tangential social content.

Item Price Tracker

People are looking to actively save money in a recessionary period like this one, spending noticeably less on big purchases, but still splurging on the occasional luxury. This is proven through increased revenue due to seasonal events like Black Friday and Cyber Monday. The desire to buy is always there, but not the urgency of the occasional seasonal event. Lolli should build an item price tracker on the Chrome extension, where you can indicate a price ceiling for an item that you would buy if any ad partners are offering that SKU at that price or less. Lolli’s engineering team can use the previously-mentioned background job that crawls through all of their ad partners’ sites and indexes all of their SKUs. When interests align, Lolli users will receive a push notification to restart habit loop if they’ve downloaded the app on their phone, but at least an email as a backup channel to restart the habit loop.

Lolli Virtual Store

The reason that people like myself always use Amazon is because it’s an everything store. Lolli is hampered by the fact that separate transactions needs to be made on different stores, but also empowered by the fact that it takes way less effort to activate a store owner on Lolli than it would on Amazon. It would be cool to see an Amazon-like aggregation experience where SKUs and prices from the ad partner sites can be queried and added to a universal Lolli checkout cart that lives in the Chrome Extension. It would also be cool to be able to add an item to the Lolli cart directly from the ad partner’s site. Items in the checkout cart are all grouped by store. It would look like one big transaction on the user side, but Lolli would be querying store-specific endpoints with affiliate codes. Lolli can even add a “universal cart fee,” charging for the convenience of curating all of the best deals into one cart. There is a significant amount of engineering work that would need to be put in, but it is relatively straightforward and doesn’t pose technical risk, in terms of something that’s not feasible or incredibly-hard to execute.

Expanding Product-Market Fit

Lolli’s in a great position with their offering in today’s economic environment. However, there will come a time way down the line when continued expansion of the Lolli product will become increasingly limited based on its current Product-Market Fit characteristics. I think there are two incredibly “oh this makes so much sense” sequences of work that can simultaneously unlock new addressable markets and market share of those new addressable markets. Depending on Lolli’s product vision, Lolli can adopt either sequence or even both with enough time.

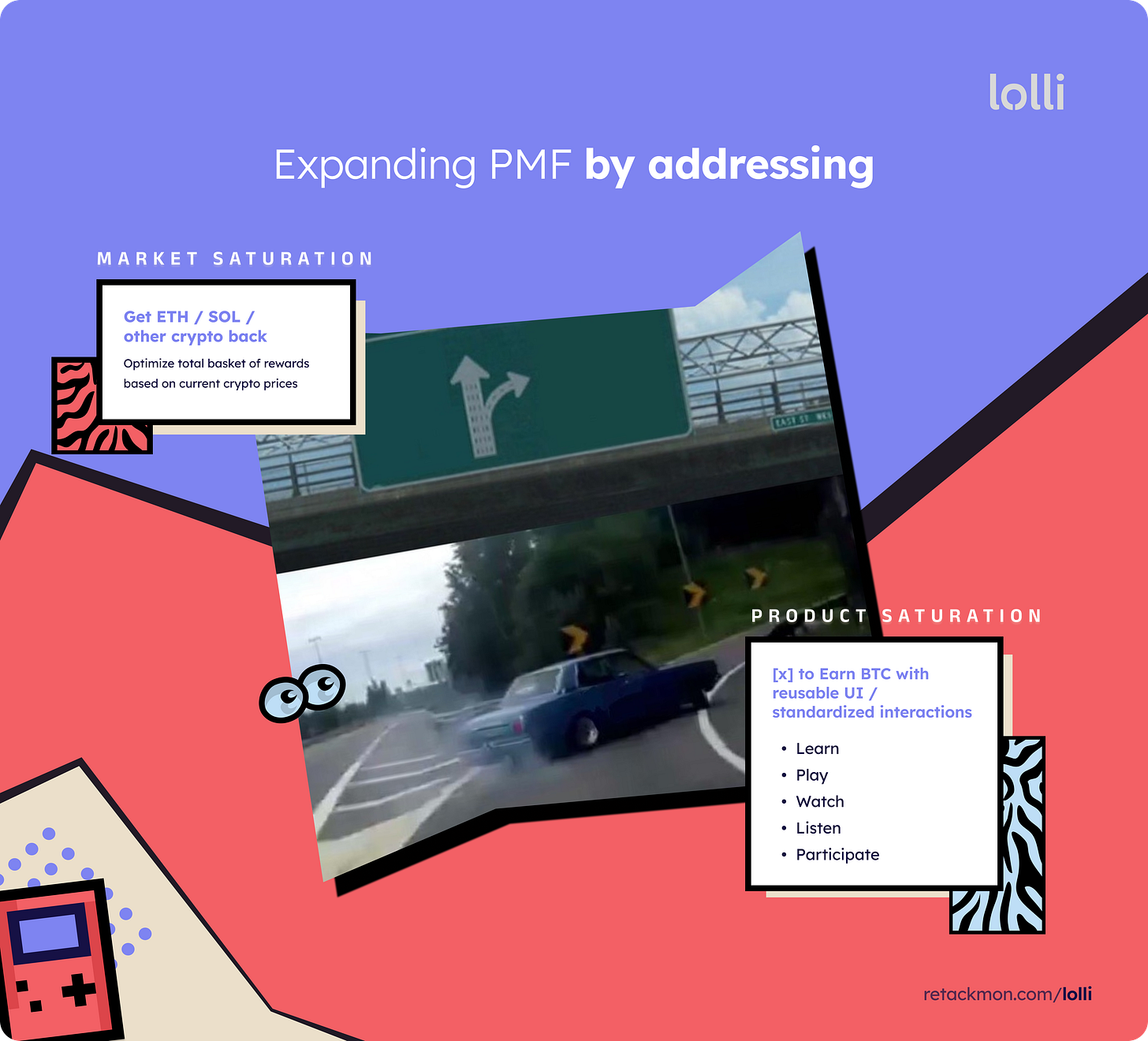

Addressing Market Saturation

At some point, it might get too hard to acquire, activate, and/or re-engage shoppers through the BTC use case. In this case, it would be really cool to see Lolli dole out other crypto like ETH and SOL, along other quantifiable rewards — interpret that how you will. There could be cool features like optimizing the total basket of rewards based on current crypto prices, forecasts, and incorporating the perspective of friends through social investing platforms like Commonstock. If this sequence of building occurs, Lolli then will position itself and be limited in further expansion as a shopping-centric company instead of a Bitcoin-centric company.

Addressing Product Saturation

Lolli’s original purpose in founding the company was to drive mainstream Bitcoin adoption. Bitcoin is still in its early innings when evaluating it on many levels, and it still has a lot more room to grow. If Lolli wanted to stay completely steadfast in the mission of driving mainstream Bitcoin adoption, shopping as a use case would not be enough to facilitate greater levels of growth. Lolli can then expand by becoming a company where you can do [x] to earn BTC, where [x] can be learn, play, watch, listen, participate, and more. Lolli’s addressable markets for both demand and supply would increase like crazy. New usage and engagement would stem from any action that could be done on a phone. New revenue would be driven by any company that wants free and/or paid attention, not only e-commerce stores who are looking to drive revenue. Lolli’s product and engineering teams can execute on this by initially creating reusable UI and standardized interactions that would solve for a lot of these use cases all in one go.

Closing Thoughts: The Origin Story

Retackmon is a new creator-focused experiment by CrafterFaster! The corporate entity behind CrafterFaster was founded at the end of 2020.

CrafterFaster has gone through a number of phases since incorporation. After interviewing almost 200 creators and synthesizing learnings, we identified our best starting problem. We took a little under 2 weeks to thoughtfully design a demo solution with a tight scope, and 3 months to code it up. The demo was an incredibly lo-fi clone of Google Docs, but specifically tailored for newsletter writers to collect and apply feedback to their posts. After coding the demo, we ran a 2-month long pilot with a super small cohort of Substack writers who had small audiences. The purpose of this experiment was to de-risk retention and validate that newsletter writers who released posts weekly would also strive to get feedback at the same cadence — given a good enough user experience. After 8 weeks, retention for the pilot cohort flattened to 50% at week 5 without any further churn. Not bad.

Even though we were able to confidently validate our retention hypothesis on a small scale, it took a meaningful chunk of time just to nail that one important dimension. There was no bandwidth to simultaneously find scalable acquisition channels and a monetization model with profitable unit economics. We decided that our de-risking approach needed to change, so we ended up adopting MVP methodology to "speed things up." Our most recent MVP iteration was a cobbled solution comprised of email, Figma, Airtable, Typeform, Stripe, and a lot of manual work outside of the MVP itself.

We saw the advantages of having overwhelmingly fast turnaround time and being able to test many dimensions of Product-Market Fit holistically at once with an MVP. However, we came to the realization that consumer expectations have risen exponentially since the term MVP was coined in 2008. MVPs don’t cut it anymore. It makes complete sense that seed rounds have become larger because it just takes more time for new entrants to displace the bar to Product-Market Fit in any market. A real business with a delightful product, not just something people regularly use. It's now clear to us that speedy, but less-than-thoughtful, product design would not satisfy the creator population. It’s also clear to us that sustainable and scalable acquisition needs to be developed alongside product efforts.

At this juncture, we're now faced with the challenge of quickly, thoughtfully, and systematically:

de-risking various dimensions of PMF in a holistic, non-isolated fashion,

shipping a focused product that has overwhelming competitive advantage in at least one important aspect that our “now” and “future” creator sub-personas value, and

acquiring new users profitably on a unit-economic basis.

This newsletter Retackmon is one of the our few validation experiments. Retackmon is a portmanteau of “Retention,” “Acquisition,” and “Monetization.” It will initially start as a newsletter that analyzes the growth strategies of today’s coolest startups. There are many reasons why we’re starting with this particular newsletter and topic set, but here are 3 big ones. We want to:

pinpoint the successful and failed aspects of products we admire,

build our own owned channel to leverage with other efforts, and

deeply empathize with creators, as a fellow creator.

We’re going to continue using this post format and Figma image templates to churn out posts covering more cool startups at a quicker cadence with every release. If you’d like to see a certain startup covered in a future post, email us at retackmon@substack.com.